Crypto = Using Digital Encryption. Currency = A System of Money. The number of Cryptocurrencies available over the internet as of December 31, 2017 is >1400 and growing. A new cryptocurrency can be created at any time. By market capitalization (see Coinranking), Bitcoin has been the largest blockchain network, followed by Ethereum and Ripple.

- Bitcoin: The first decentralized ledger currency founded by the pseudonym Satoshi Nakamoto (is it Craig Steven Wright?) in 2009. It’s currently the cryptocurrency with the most famous, popular, notable and highest market capitalization.

- Bitcoin Cash is a hard fork from Bitcoin with increased block size from 1 MB to 8 MB.

- Ethereum: Supports Turing-complete smart contracts and was founded by Vitalik Buterin in 2015.

- Ethereum Classic is an alternative version of Ethereum whose blockchain does not include the DAO Hard-fork.

- Ripple: Founded by Chris Larsen & Jed McCaleb in 2013 is designed for peer to peer debt transfer and is not based on bitcoin.

How It works

The Eight Concepts Explained

- Encryption is the process of converting information or data into a code, especially to prevent unauthorized access. When using cryptocurrency as a medium of exchange, instead of using a single key for both encryption and decryption, separate encryption keys are used for both. A user generates a pair of keys that are mathematically linked to each other. One key (the public key) is used for encryption and the other (the private key) is used for decryption. The public key is shared (used as a wallet for payment) where anyone with this address can send encrypted information (bits of data, bitcoin) to another party. Once encrypted, the information can only be decrypted with the corresponding private key.

- Decentralized are the transfer of decision making power, assignment of accountability and responsibility for results. It is accompanied by delegation of commensurate authority to individuals or units at all levels of an organization (bitcoin protocol). Cryptocurrencies are a standard, or a protocol just like HTTP, IP, or the internet and they aren’t wholly owned by any individuals. It’s a network centric system that operates by simple mathematical rules that everyone who participates on the network agrees upon. Through this simple mechanism and invention, they operate within a decentralized network of computers to agree on what transactions occurred.

- Distributed Systems as a model whose components are located on a network of computers. These computers communicate and coordinate their actions by passing messages along to one another. This is the system by which nodes are governed.

- Open Source Code software that can be freely used, changed, and shared (in modified or unmodified form) by anyone. Open source software is made by many people, and distributed under licenses that comply with the Open Source Definition. Cryptocurrencies are typically open-source. This means developers can create API’s (application program interface) without paying a fee and anyone can use or join the network.

- Transactions are made in an instance of buying or selling something; a business deal. When you send Bitcoin, a single data structure (Bitcoin transaction) is created by your wallet client using an encrypted electronic signature. It is then broadcasted to the network via a public ledger to provide mathematical proof that the transaction actually occurred. Bitcoin nodes on the network will relay and rebroadcast the transaction, and if the transaction is valid, nodes will include it in the block they are mining.

- Public Ledgers or Blockchain (originally block chain) is a distributed database that is used to maintain a continuously growing list of records, called blocks in which transactions made in bitcoin or another cryptocurrency are recorded chronologically and publicly. The public ledger consistently grows as ‘completed’ blocks are added to it with a new set of recordings. The blocks are added to the blockchain in a linear, chronological order. Each node (computer connected to the Bitcoin network using a client that performs the task of validating and relying transactions) gets a copy of the blockchain, which gets downloaded automatically upon joining the Bitcoin network. The blockchain has complete information about addresses and their balances right from the genesis block to the most recently completed block.

- Nodes are points of intersection/connection within a network. A node is simply a computer that is participating in the global Bitcoin network by speaking a protocol, ‘the Bitcoin’ protocol, that allows these intersections on the network to communicate with each other. What they do is essentially propagate transactions and blocks. Nodes that are participate on Bitcoin serve the most important purpose; every one of them acts as an authoritative, verifier of every single transaction and block. This type of node is more precisely referred to as a fully validating node. The node takes the transaction data, and independently verifies every aspect of that transaction. It authoritatively reconciles it with its own copy of the ledger to determine whether the funds have been double spent. If you send a node a transaction that is incorrect, it will not only reject the transaction, it will stop talking to you. A node that tries to propagate incorrect information is quickly isolated, the nodes it attempts to communicate with will ban and disconnect from it. The most important concept to recognize and take away from this is the nodes on the network don’t trust each other. Miners (see below) receive the transactions that nodes decided were valid, and they give back blocks at the pleasure of the nodes that will decide if they are worthy of being propagated because they are valid. The validity of the consensus rules is not determined by miners, they sequence transactions into a block. The validity of the consensus rules is determined by nodes, because they will not propagate lies.

- Mining is the process by which transactions are verified and added to the public ledger and is also the means through which new bitcoin are released. Anyone with access to the internet and suitable hardware can participate in mining. The mining process involves compiling recent transactions into blocks and trying to solve a computationally difficult puzzle. The computer (or cloud of computers) who first solves the puzzle gets to place the next block on the blockchain and claim the reward for solving this math problem and providing this critical function to the system. The reward (new bitcoin) incentivize mining; both the transaction fees associated with the transactions complied in the blocks as well as newly released bitcoin. The amount of new bitcoin released with each mined block is called the block reward. The block reward is halved every 210,000 blocks or roughly every 4 years. The difficulty of mining adjusts itself with the aim of keeping the rate of block discovery constant. Thus, if more computational power is employed in mining, then the difficulty will adjust upwards making mining harder over time.

Limits & Regulations

Theoretically, there is no limit. Realistically there are only so many cryptocurrencies that will be accepted in a large enough scale for conventional use.

However, each cryptocurrency has a defined limit. For example bitcoin currently has a limit of 21 million coins. Others are in the billions, and others have no limit. Because it is all just code, these settings can be changed at any time, although very unlikely because everyone has to agree to change it. It can also be duplicated an infinite number of times. Anyone can start their own currency, although it is very unlikely to take off. There are hundreds of currencies but most are worthless.

Moreover, banks and Governments (in some countries that might be very well the same) naturally are not happy with the current system of how cryptocurrencies are traded and develop as they have no control over it, may be able to track only within limits and could not collect their share. → Legality of bitcoin by country or territory

“You’d better check out very carefully about the applicable laws & regulations in your – and don’t you forget about the nodes! – area before going into cryptocurrency gambling.”

– Eric Roth

Market Capitalizations

Market Capitalization is one way to rank the relative size of a cryptocurrency. It’s calculated by multiplying the Price by the Circulating Supply: Market Cap = Price X Circulating Supply. View data for > 2000 cryptocurrencies. → Cryptocurrency Market Capitalizations

The Environment

What do Bitcoin and Las Vegas and Hamburg and Sri Lanka have in common? The size of their carbon footprints! Hardware and IP addresses analyzed to assess the carbon footprint of the cryptocurrency: The use of Bitcoin causes around 22 megatons in carbon dioxide emissions annually. → Science Daily

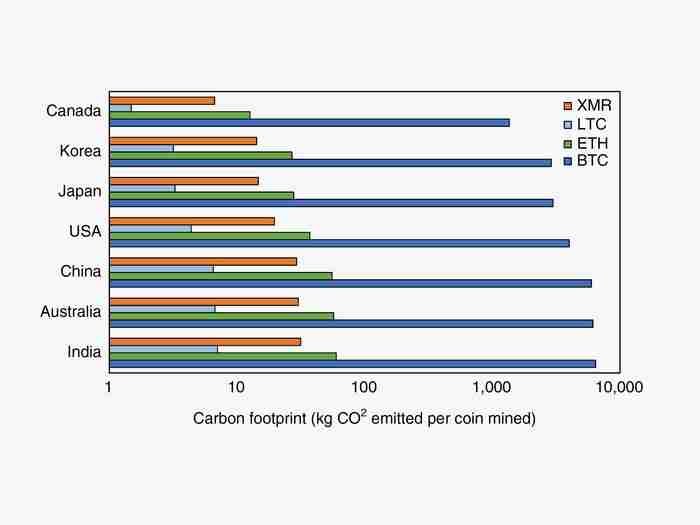

The carbon footprint of a cryptocurrency varies depending on how much energy the network uses, and the kind of energy used where the coin is mined.

Carbon footprint (kg CO₂ emitted per coin mined)

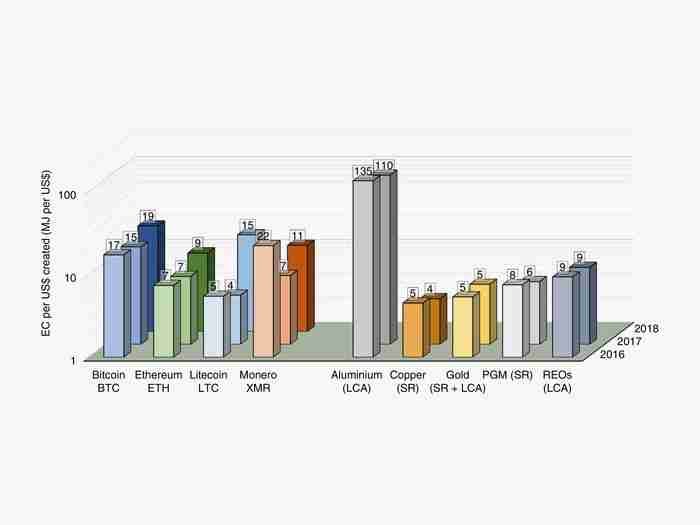

In general, it takes more energy to mine $1 worth of cryptocurrency than to mine $1 of precious and commodity metals. It was 17 megajoules (MJ) for a dollar’s worth of bitcoin but just 4 MJ for a dollar’s worth of copper. Aluminum is an exception as it’s extremely energy-hungry. On average, 1 MJ can power around 39 to 40 homes.

EC* per US$ created (MJ per US$)

* = The Echoin public chain aims to create a decentralized energy trading network using blockchain technology. The Echoin Ecosystem will use a dual token system. EC is the gas in the Echoin public chain ecosystem, used to pay the network maintainers and verification nodes. The EUSD is a stable currency generated by the pledge of fiat currencies (i.e. US Dollars). EUSD will be issued on the Echoin public chain, and its security and credibility will be backed by bank(s) and/or other independent agencies.

Conclusion

The virtual as well as physical societies are full of “Horray” for cryptocurrency trading and praises Bitcoins & Co. as the “New Gold” – but there are other opinions floating around too. Surprisingly – and therefore weighing in – from the bailout receiver Goldman Sachs and the convict Jordan Belfort:

What’s More

My Blog ( 96 )

Dependence (9) Fiction (7) Karma (7) Landmarks (8) Paramount (8) Spectrum (9) Spotlight (8) Take Off (9) Terra Shapes (8) Trepidation (8) Unique (7) Virtue (8)

Amazing Stuff (9) Beyond Known (9) Controversial (9) Digital World (10) Inequities (10) Innovative (9) Metaphysics (9) Orbiting Entities (10) Our Society (10) Outer Space (9) Value Creation (10) Yearnings (10)