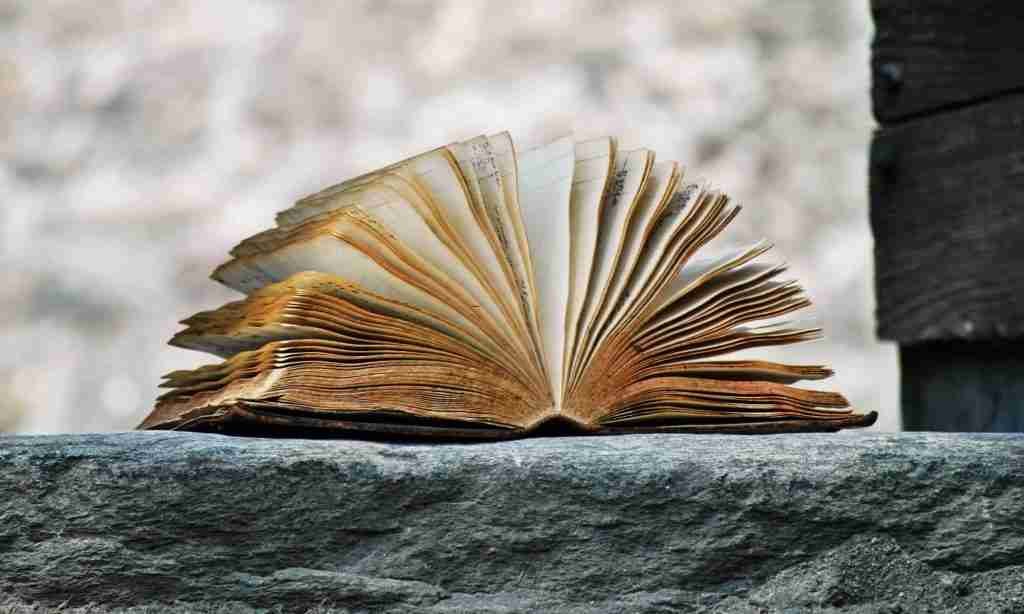

The history of payment methods mirrors the economic and cultural evolution of society. Initially, barter systems allowed direct exchange of goods and services but required a double coincidence of wants, making transactions inefficient. This led to the emergence of commodity money, where civilizations used items like salt, cattle, and grains as a medium of exchange. The adoption of metal coins further improved trade by offering a durable, standardized currency.

The introduction of paper currency during China’s Tang Dynasty marked a major shift, providing convenience and paving the way for banking systems. The rise of banks enabled checks and drafts, fostering trust and security in transactions. In the modern era, electronic payments, credit cards, and online banking have streamlined financial interactions. Digital currencies like Bitcoin, powered by blockchain technology, have revolutionized security and transparency in payments.

Cultural and economic factors continue to shape global payment preferences. Attitudes toward cash, credit, and digital transactions vary across regions, influencing consumer behavior and financial systems. Understanding these evolving dynamics is key to grasping the broader impact of payment methods on economies and daily life.

Payment Systems: Pros and Cons

In recent years, our dependence on various payment systems has significantly increased, driven predominantly by the rapid advancement in technology and a growing preference for digital transactions. One of the most notable advantages of this shift is the convenience associated with digital payments. Consumers can make transactions instantly, often without the need for physical cash or checks, thus streamlining the purchasing process. This ease of use has led to a marked decrease in cash reliance, which, while beneficial for efficiency, also raises concerns about the implications for society.

Despite the positive aspects, this transition towards cashless transactions is not without its drawbacks. One major concern is the heightened risk of cybersecurity threats, as digital platforms become prime targets for hackers. Data breaches can lead to significant financial and personal consequences for consumers, as well as erosion of trust in these payment systems. Furthermore, the reliance on electronic methods can inadvertently exclude unbanked populations – individuals without access to banking services. This exclusion not only perpetuates economic disparities but also limits opportunities for these populations to participate fully in the economy.

Socioeconomic implications extend beyond accessibility issues; they also encompass privacy-related concerns. In a cashless society, every transaction is traceable, leading to potential surveillance and loss of financial anonymity. As payment systems continue to evolve, the balance between the benefits of cashless transactions and the vulnerabilities they introduce becomes increasingly complex. Individuals and policymakers must consider how to navigate this landscape to harness the advantages of innovation while mitigating potential risks. It is essential to foster inclusive policies that address both the technological advancements and the socioeconomic repercussions to ensure a balanced approach toward our growing dependence on payment systems.

“If you think nobody cares about you, try missing a couple of payments.”

– Steven Wright

Current Means of Payment

The landscape of payment methods continues to evolve, significantly impacting how transactions are conducted globally. Currently, the most commonly utilized means of payment include cash, credit and debit cards, mobile payments, and cryptocurrencies. Each method possesses distinct advantages and disadvantages, influencing consumer preferences and behaviors.

- Cash has long been the traditional payment method, favored for its anonymity and the absence of transaction fees. However, its physical nature can introduce issues of security, such as theft and loss. Furthermore, as health and safety concerns arose during the pandemic, many consumers began to favor contactless options. As a result, the use of cash has seen a decline in various markets.

- Credit and debit cards remain immensely popular due to their convenience and the flexibility they offer consumers. Credit cards, in particular, allow users to make purchases even when funds are not immediately available, often coupled with rewards programs. Debit cards, on the other hand, facilitate spending directly from bank accounts, promoting responsible financial behavior. Nevertheless, concerns persist regarding potential debt accumulation with credit cards and the vulnerability of card information to fraud.

- In recent years, mobile payments have gained traction, propelled by the rise of smartphones and digital wallets. Services such as Apple Pay, Google Pay, and others enable users to conduct transactions swiftly and securely, incorporating features like biometric authentication for added security. While mobile payments are increasingly accessible, their adoption still depends on the availability of compatible technology among retailers and consumers alike.

Furthermore, the advent of Cryptocurrencies has introduced a new dimension to means of payment, characterized by decentralization and enhanced security through blockchain technology. Nevertheless, volatility remains a significant concern, as the value of cryptocurrencies fluctuates widely. Overall, as consumer preferences continue to shift towards digital and contactless payments, businesses and financial institutions are adapting to accommodate this burgeoning trend.

The Future of Payment Methods

As we progress further into the 21st century, the landscape of payment methods continues to evolve, driven by technological advancements and shifting consumer preferences. One of the most significant trends on the horizon is the integration of blockchain technology into payment systems. Blockchain offers a decentralized approach that enhances security and transparency, making transactions more efficient and reducing the risk of fraud. This trend is anticipated to be particularly transformative for international remittances and supply chain financing, moving us closer to a seamless global economy.

Another emerging trend is the rapid adoption of biometric payments, which utilize fingerprints, facial recognition, or other unique physical traits for authentication. This method not only streamlines the payment process but also heightens security by reducing the chances of unauthorized access. As consumers become increasingly comfortable with technology and prioritizing convenience, biometric methods are expected to gain traction, especially in retail and mobile payment settings.

Additionally, Central Bank Digital Currencies (CBDCs) are likely to become a more prevalent means of payment. Governments around the world are conducting research and pilot programs to assess the viability and potential benefits of CBDCs. These state-backed digital currencies aim to enhance the efficiency of the monetary system, facilitate peer-to-peer transactions, and provide an alternative to traditional banking. Consequently, their rise could have profound implications for monetary policy and financial stability.

Future consumer behavior is expected to converge towards a preference for swift, secure, and straightforward payment methods, influenced by ongoing technological advancements. Regulatory changes will also play a crucial role in shaping these payment systems as governments seek to address issues of privacy, security, and compliance within a rapidly evolving marketplace. In conclusion, the future of payment methods will likely be characterized by innovations that enhance user experience and security while keeping pace with the global economic landscape.

A World Without Means of Payment

Back to the Roots

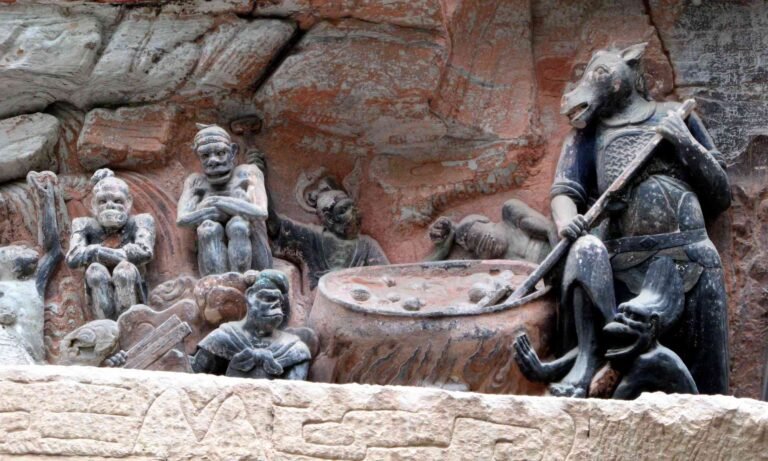

Imagine a world functioning without means of payment as we know them today. In this scenario, the practices of buying and selling goods and services would undergo a profound transformation. Without cash, credit cards, or digital payment systems, society would need to revert to barter or alternative methods of value exchange.

One of the most traditional methods of exchange is the barter system, where goods and services are directly traded without the use of money. In this world, individuals and businesses would rely on the mutual agreement of value.

For example, a farmer could exchange vegetables for tools with a blacksmith, fostering community relationships. While this could strengthen local connections, it may also introduce complexities regarding the evaluation of worth.

Advance to new Systems

Without conventional means of payment, creativity in exchanging value would likely lead to new (old) systems. Technology might empower individuals to use alternative currencies, time-based exchange, or credit systems based on trust and reputation. Social platforms could arise to facilitate these transactions, enabling people to share resources directly. However, such solutions would require a foundational trust beyond what a traditional monetary system provides. Ultimately, envisioning a future devoid of established means of payment compels us to understand the underlying principles of value in our economy. While challenging, this shift could yield opportunities for closer community bonds and innovative ways of facilitating trade.

What’s More

My Blog ( 112 )

Dependence (10) Fiction (10) Karma (9) Landmarks (10) Paramount (9) Spectrum (9) Spotlight (10) Take Off (9) Terra Shapes (9) Trepidation (9) Unique (9) Virtue (9)

Amazing Stuff (9) Beyond Known (10) Controversial (9) Digital World (10) Inequities (10) Innovative (9) Metaphysics (9) Orbiting Entities (10) Our Society (10) Outer Space (9) Value Creation (10) Yearnings (10)

My Interests ( 115 )

Site Forum

Curious to dive deeper and ready to share your thoughts on this? Join the conversation and be part of the FORUM@ericroth.org Your online discussion board providing space for engaging exchanges on specific topics and shared interests across this website.